4:10pm

market closed near the high of the day. As I mentioned, it’s a good short entry if this is the case. Enter two positions.

Coin say tomorrow is down. considering VIX is in green with SPX up more than 2%, tomorrow will be down with very very high probability. But again, TA is not crystal ball; it’s based on probability.

3:10pm

key things to watch for the close before judging the midterm:

1) SPX 200 MA can hold or not

2) UCD break the trendline or not

3) VIX close in green or red if SPX close with a 1% + gain

4) 10 year note yield new high?

5) financials: it leads the down now

2:58pm

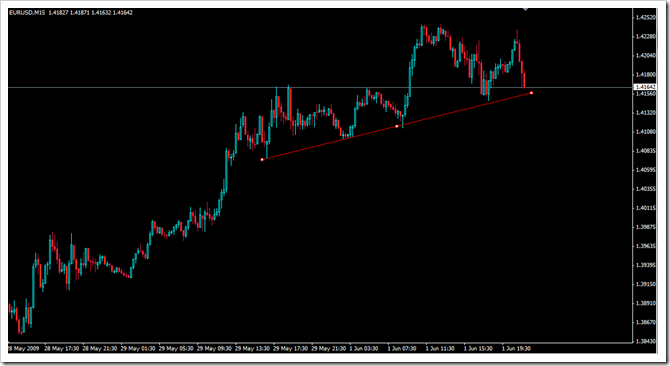

EUR/USD is trying to test the trendline a fifth time. i doubt it will hold.

2:00pm

TNX will be an issue for bulls if it keeps moving here. it seems that sub 5% mortgage rage is gone forever…

12:58pm

diagonal broken. a good short entry to me.

12:41pm

Market is strong or I will call it crazy. overbought and divergence, but it’s not short signal. In a trend day, it will keep overbought till close, so if we really close at day high, it could be an entry for a quick swing.

i entered a long position one hour ago in the transport sector and added to the trading blog in real time.

11:50am

Market makes new high after 10:30am, so could be a trend day today.

Obaba is about to talk to GM chapter 11 on CNBC now.

One suspicious chart, VIX is still in green!!!

10:08am

Oil and Gold is soaring; dollar tanks further… Only hope for bears is the yield on 10 year notes, it’s climbing back now…

Dollar is closing to a turning point and I will watch it closely.

10:00am

It’s important to see if the gap can be closed within half hour. No fill before 10:30am will be very bullish and i will by some strong sectors i mentioned. I will not begin buying the general market since nothing convince me a bull market is here. still, wait for the short entry for midterm… but that may take quite some days.

9:52am

New high and 200 DMA reached. I was wrong and need to correct my count.

8:04am

morning guys. another new week.

Futures indicate a gap up and let’s see how long that gap can hold and how high it will shoot up from here. it’s already down a little bit from its peak last night. Also GM chapter 11 is another thing to watch. see how the market react to giant’s behavior.

0 Good Insights:

Post a Comment