Today, I finished half of the book Elliott Wave Principle by Prechter. It’s not my first reading on EW, but it’s the most clear and organized one. I take quite some notes from the book and I’d like to share it here for your reference. With viewing charts after charts, I begin to feel more and more about strength of nature law inside this market. The sentence in the book summary this feeling very well:

“Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the linear causality to which one becomes accustomed in the everyday experiences of life. Nor is the market the cyclically rhythmic machine that some declare it to be. Nevertheless, its movement reflects a structured formal progression.”

Big Rules (no exceptions) :

1. Within motive waves, wave 2 never retraces more than 100% of wave 1, and wave 4 never retraces more than 100% of wave 3.

2. Wave 3, moreover, always travels beyond the end of wave 1.

3. In price terms, wave 3 is often the longest and never the shortest among the three actionary waves (1, 3 and 5) of a motive wave.

4. In an impulse, wave 4 does not enter the territory of (i.e., "overlap") wave 1. This rule holds for all non-leveraged "cash" markets.

5. Extensions typically occur in only one subwave; the most commonly extended wave is wave 3.

6. Corrections are never fives; only motive waves are fives.

About Diagonal:

- A diagonal triangle is a motive pattern yet not an impulse, as it has one or two corrective characteristics.

- An ending diagonal is a special type of wave that occurs primarily in the fifth wave position at times when the preceding move has gone "too far and too fast"

- A rising diagonal is bearish and is usually followed by a sharp decline retracing at least back to the level where it began. A falling diagonal by the same token is bullish, usually giving rise to an upward thrust.

- When diagonal triangles occur in the wave 5 or C position, they take the 3-3-3-3-3 shape.

Correction waves (4 categories):

Correction waves are very complicated and has various kinds of changes and irregular corrections. I only list the outline of the book and you really need to get into details if if want to master the these waves. The book indeed give some insights in identifying an irregular wave. Wedges, triangles and flags are commonly used patterns in TA, but reading EW brings something fresh in the understanding.

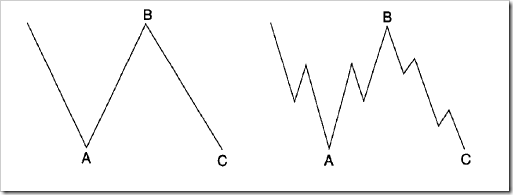

- Zigzags (5-3-5; includes three types: single, double, and triple);

- Flats (3-3-5; includes three types: regular, expanded, and running);

- Triangles (3-3-3-3-3; four types: three of the contracting variety (ascending, descending, and symmetrical) and one of the expanding variety (reverse symmetrical);

- Double threes and triple threes (combined structures).

Lables:

This is the Universal rule to lable the wave. This is for everyone to speak the same language and easy for others to understand the counts…

To be more specific,

- The labels for actionary waves are 1, 3, 5, A, C, E, W, Y and Z;

- The labels for reactionary waves are 2, 4, B, D and X.

All reactionary waves develop in corrective mode, and most actionary waves develop in motive mode. The preceding sections have described which actionary waves develop in corrective mode. They are:

- waves 1, 3 and 5 in an ending diagonal,

- wave A in a flat correction,

- waves A, C and E in a triangle,

- waves W and Y in double zigzags and double corrections,

- wave Z in triple zigzags and triple corrections.

0 Good Insights:

Post a Comment