5:41pm

OK, i am back now. there is surprise with the market and it’s getting closer to our zone. A gap down tomorrow will fit everything into my plan well…

The friend i met is a doctor (not my Ph.D. kind of doctor, but really a doctor that see patient) and he has been trading for years. He showed me his account on Ameritrade today and you know what, he is doing really good in the past three months… account doubled and almost no losing trade in closed transaction. he strongly recommend the software he used “Vecter Vest”. I’ve never used this one before and believe it won’t be fitted to my style. but in case you are looking for something, it may worth trying.

2:36pm

Nothing much right now. market is heading to our target smoothly. I will see a friend in about half hour later, so may not update here till market close. will update then.

1:32pm

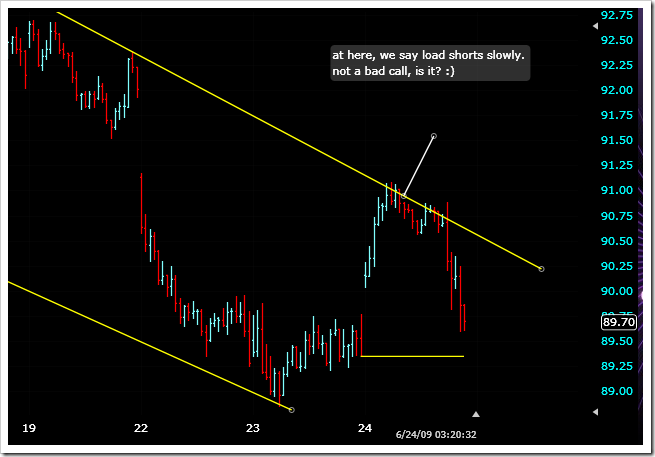

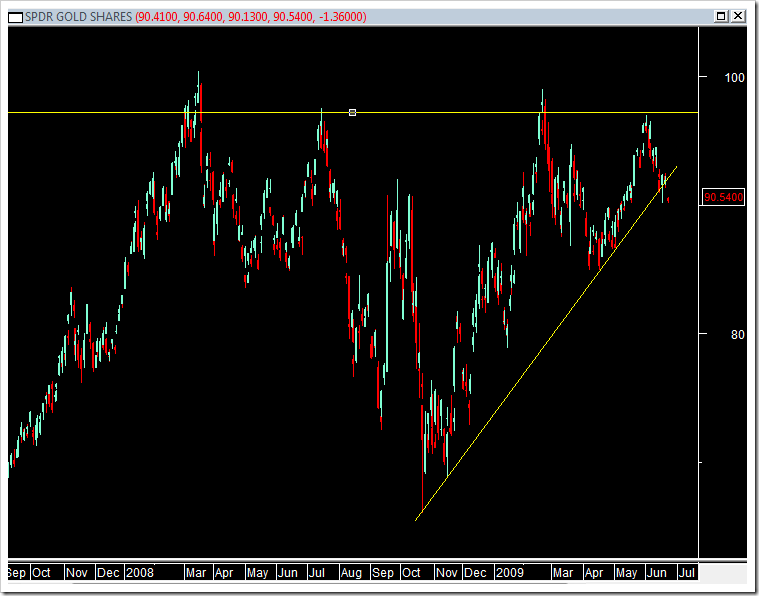

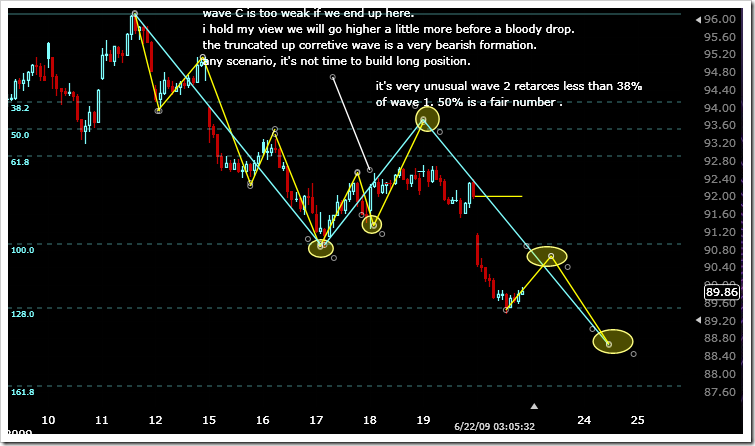

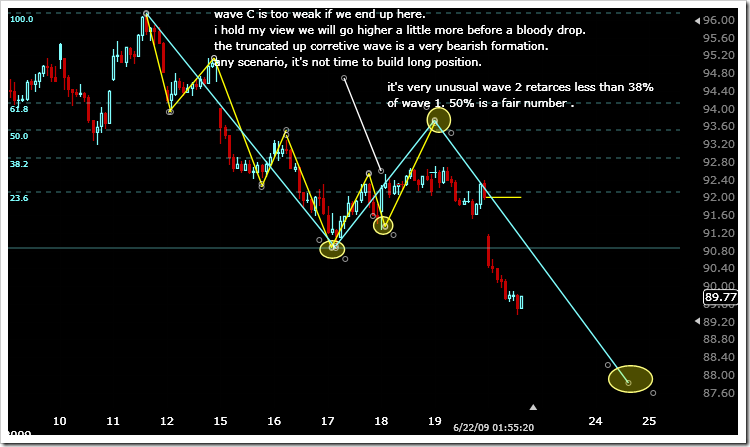

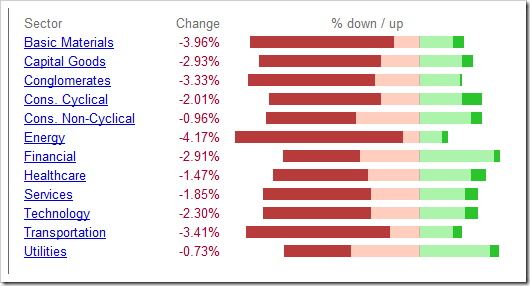

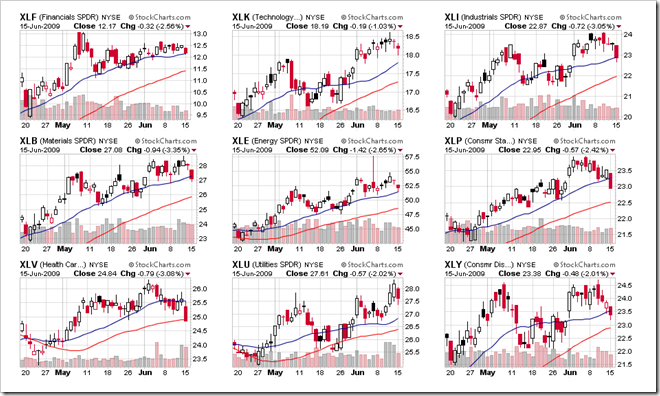

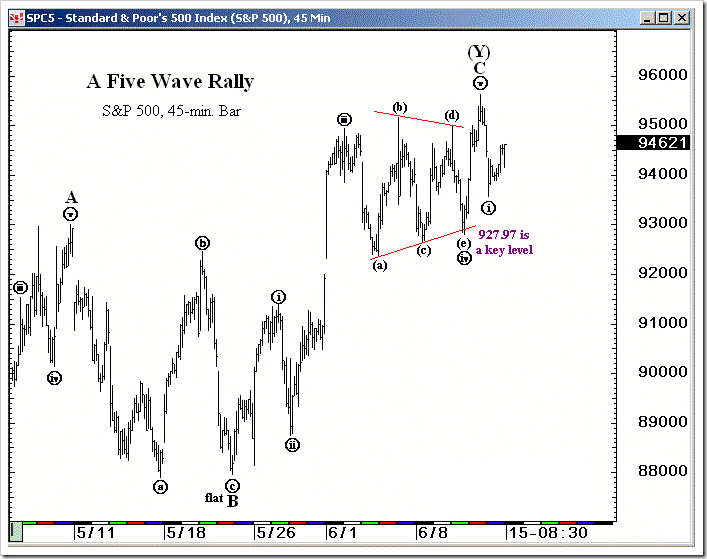

no rebound at all. bears quite in control. major wave structure is here. a larger time scale than the one i usually posted here.

1:04pm

perfect wave structure. We may see some reversals from here. sell TWM @ 43.83, $2 in the pocket, will buy back. I will leave BAC and one other short for a while. at beginning stage of drop off, there is going to be some shake off action. be cautious bear.

12:39pm

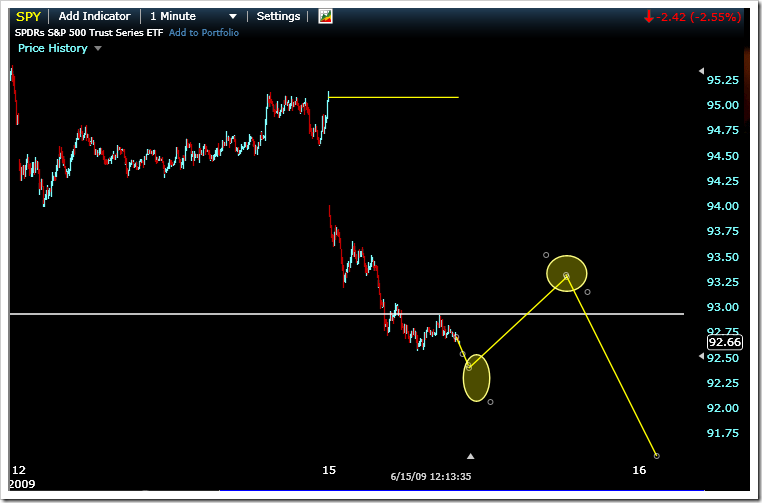

new target, not far though

12:34pm

Target reached. but this wave may further extend after some consolidation here. wave 5 is extend and now we are in 5 (3).

12:18pm

Quick idea:

11:54am

To indentify good entry point, we need to focus on both time and space. As you see from the 1 min chart below, yellow marks are my projected moves in early trading hours. It seems that space wise, i am doing very good, both low and high are right on my target, but time wise, I am 3 hours early. I have to say, timing is more important. Dow will visit 7000 or 10000 eventually, but key question is which first … :)

11:17am

look at the solar sector, LDK, YGE, STP etc. i’ve mentioned weeks ago that “if there is any sector i wanna to go long, it will be solar”.

11:12am

the day after MDD most likely closed as a doji. so the best strategy is either 1) no action; or 2) sell on rally & buy on dip... very short term trade, not for swing. also my coin system says it’s up day: http://rollinglines.blogspot.com/2009/06/coin-prediction-0615-0619.html