next 10 days will be crash window… it can be as early as tomorrow…

October 12, 2010

August 9, 2010

August 7, 2010

June 30, 2010

this is what happened

after last night’s post…

let’s have this simple. market will touch 850 area much sooner than you expect…

June 29, 2010

wow

China SSEC market crashed first tonight…

if you study this market carefully, you will see that China market has lead the world market ever since 2006…

June 25, 2010

June 6, 2010

another step to crash

EUR is already in free fall mode. stock market will follow soon and this can be as early as tomorrow…

May 28, 2010

the best setup in a bear market

is the major accumulation day like this…

i out some short positions this morning when we break out the neckline of the HS pattern. if i were in front of the computer, i will definitely add position back at the end of the day. so if the market gap up tomorrow, i will load up some bullets.

if we see from the bull side, 1140 is the target for this HS breakout. once we can get there, then it’s party time for bears…

again, i never doubt the bear market is over though lots of my comrades changed their view along the way. sometimes we have to keep some faith…

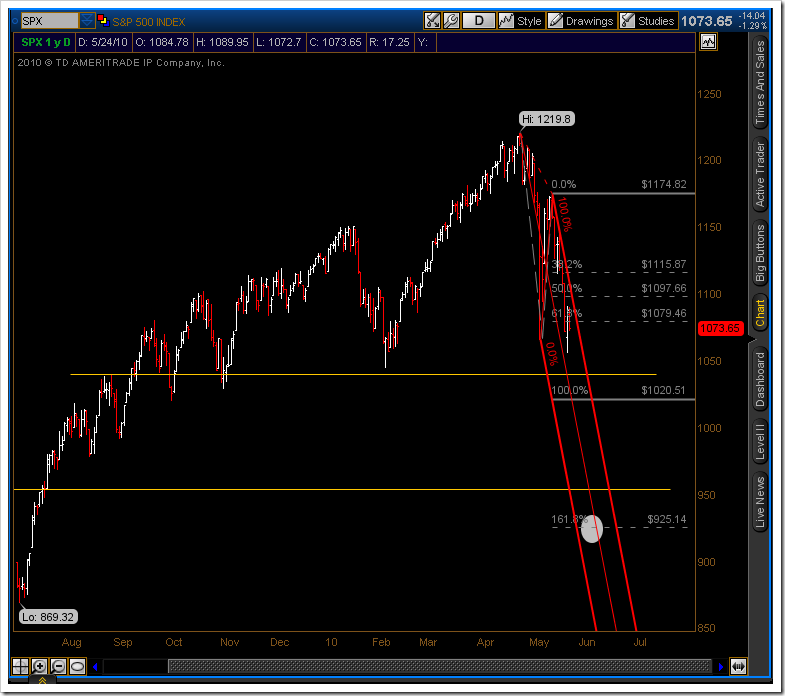

May 24, 2010

More drop in SPX

This is a very deep channel… i hope you’ve out all long positions at the last correction as i outlined there: http://rollinglines.blogspot.com/2010/05/chart.html

every ST high is a chance to add short position…

still holding TZA and QID, adding my favorite MTL back to the short list ; also short EUR/USD and GBP/USD……

May 17, 2010

new low in EUR

break below the 2008 low tonight. what a night…

many things are lining up for a crash… let’s see how this probability game goes on…

May 13, 2010

1.46 target reached

If you were shorting GBP with me, at least 300 pips in the pocket right now…

more downside to go. As I said earlier, GBP will make record low in 2010/2011…

May 12, 2010

GBP good short opportunity

if rally to 1.5, target 1.483, then to 1.46 region…

stock market has show a nice rally, we are about to turn head down soon….

May 9, 2010

bullish monday

as my last drawing shows, we will see some rebound very soon, possibly next monday. 1150 now serves as the resistance and then 1200. 1200 should be the ultimate goal for this rebound…

for the downside, there is a lot of room, even a huge crash in sight. let’s discuss that after the market flip over again…

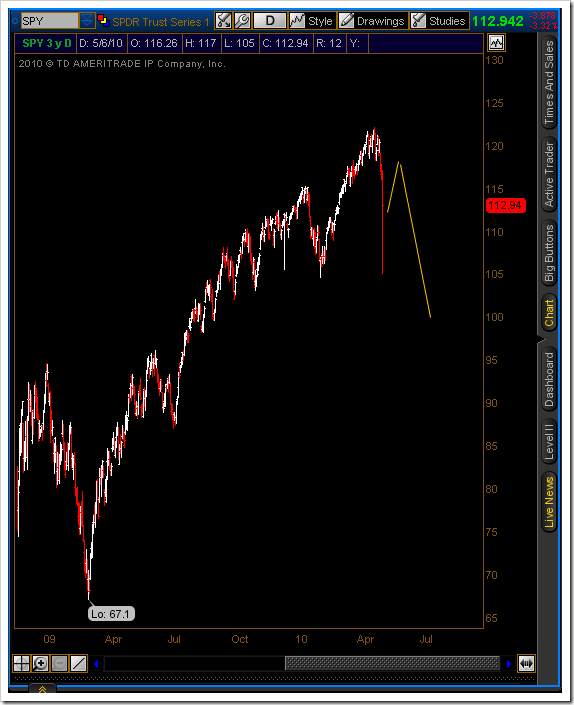

May 7, 2010

A chart

i really hope all the boom we saw in the past months are true and we can get away from the recession. however, it seems we are getting to the point that every corner of the world will be affected… this could be a reason i am not happy at all after a huge change in the account…

if still sitting on any long position, this rebound might be the last chance…

May 3, 2010

1150 in sight

it indeed gapped up and fade at the line…

move stop to entry price and will hold the short for a while. a key support at 1150…

April 29, 2010

April 28, 2010

GBP/USD

Yesterday, i closed all the EUR short position and kept this GBP short. this is my only holding right now. another hundred pips to go at least…

as i mentioned, i will open some short position tomorrow morning. the best case is that it gap up and kiss the line above…

April 27, 2010

Miss the train?

In the last post, I’ve stated very clearly that I will load the short at 1230, however, market turned down directly then on and did not give me the chance to close the small gap… see how it reacts tomorrow, if it’s a consolidation day, I will load up some at Thursday morning. I guess this is it… when i super bear like me are hesitating about any short entry, it should be the time for a u turn.

the only thing worries me is that the uptrend is obviously a three wave structure if stopped here… it need another wave up to finishes the abc-x-abc… anyway, a multi-week downturn is insight…

EUR and GBP shorts are doing great and both rewards me more than 100 pips since last post… take some profits off the table and will add back.

two weeks later, I will add in some currency daily trading signal here everyday around 11pm CA time…

April 26, 2010

61.8% retracement

I’ve been away from stock market for for 3 weeks and I know here has been quiet for a while. I do not want to join the long side and it’s not good time to short either, so step away is the only choice for me.

my long term bearish take on stock market remains strong. If you are hunting for a short entry just like whati am doing here, 1230 is the line to try something. 61.8% retracement is the most common scenario in wave2 and I do not think market can get over it in one shot if this is not the destination.

USD has been hanging around for a while and I am ready to changed my hedged position to naked short on EUR and GBP sometime next week.

March 23, 2010

March 17, 2010

APPL put

No update on stock market for past two weeks. Not a single position or trade in stock/option for past 10 days and I am so glad to see SPY has been up in row for 14 days! In any measure, this up move is close to be exhausted.

I load slight APPL April 230 put at the end of day @ 10.1. Considering Asian market is flying high right now, this move could be a a little premature. let’s see. I simply love the fact that AAPL is outperformed by QQQQ in a up day and both 60min and 5min trendline is broken.

Something I am not consistent with myself is that i closed the last UCD long positions tonight and naked short on USD right now. EUR/USD will rebound more if 1.385 is taken out. however all this move is just a rebound for EUR, it still has a long way to fall…

A strange portfolio combination for me. light position and let stop works its way.

March 13, 2010

China housing bubble

For these for you can read simple Chinese, here is an apartment with one million USD in Shanghai, not the best area, 5 year old apartment and no decoration anywhere…… http://shanghai.anjuke.com/v2/prop/view/15478906

I am not calling the tops for China housing market. the craziness may go on for months or years… but once China starts collecting property tax on housing, everything is over. Before a property tax is collected, local government has to stimulate local land prices in various ways to gurantee its yearly income…

March 4, 2010

China’s housing price curve

a graph I’ve been looking for quite sometime.

i believe all of you have heard how the housing price is doubling in Beijing and SHanghai in the past year, 2009. I know such abnormal behavior is either wave 3, the strongest trend wave or wave 5, the final push. it sees that the later more appropriate in the chart below…

However, you can hardly tell how the wave plays out, extended or not… the key info from the chart is that once the push up is over, it’s going to be the top for a long long time……

3/3/2010 market review

USD is in a healthy correction last two days as I expected early this week, GBP and EUR both retraced around 300 pips. Again, when everyone say USD is strong, you need to be careful. I believe lots of stops have been taken out and then the real drop is coming… :)

The weakest pair is GBP/USD right now and I expect this pair will make record low this year, below 1.3. British will go severe recession in next few years and it started with the Pound.

As a hedge, you can long some EUR or AUS now.

For the stock market, I know lots of my bear comrade are turning bull now, lots of… this is also what i’ve been expecting ever since the rally starts… time will tell soon…

March 1, 2010

USD may consolidate for a while

when everyone starts saying EUR and GBP is over, we need to be cautious.

I agree with the statements, but it will not happen in a straight shot. some weak hand must be shake off before a more bloody drop…

some prepare for some range trading ahead…

February 19, 2010

wave 3 target

in the yellow zone, still 300-400 pips to go… be patient, bears…

stock market will gap down tomorrow… you may say it’s news driven… well, let’s say it’s coincidence again:)

February 18, 2010

New Low in EUR

is expected tomorrow… I think only super USD bull can catch this trade, since the retracement is really sharp since last week

for past two weeks, i am shorting EUR/USD and hedging with AUD/USD long. still keep the position right now

stock market will resume the downtrend very soon… i add in some TZA long today

February 10, 2010

February 4, 2010

January 31, 2010

Closed EUR/USD short position

A very nice ride for me in the past two months. closed all the positions last Friday. it may have a push to 1.37 region, but 1.38 is already a good number for me. expect a rebound back to 1.44 region in the coming months, then it will be another great opportunity to join the short side.

Stock market may see some rebound next week. i reduced quite some short positions last Friday, only keeping TZA long and MTL short right now. will add back if market test back the 1130 region. but remember, this is the very early stage of the downtrend, short at high is the theme.

China and HongKong market again confirmed the downtrend a month early than the western world. The global eco recovery leader has led the market for the whole downtrend ever since 2007 in both long and short signals. just watch it closely.

January 28, 2010

January 27, 2010

January 25, 2010

The tide has changed

This is still the very early stage of drop. we may or may not have some rebound Monday morning, don’t count on it.

Two week ago, I called the Jan 14-15 is the top, however the top is Jan 19. From the chart below, you can see why. The same chart, weekly point to 15th, but daily point to 19th (just change the time scale)… no idea how this happens. but it’s not important anymore…

My EUR/USD is doing great, but USD/JPY is hit hard recently. No gain on Forex in the past two weeks…

January 17, 2010

Next year, again

today is a sad day for me… Charger is not its own pace and eat the loss to Jet. sigh… what a season for chargers…

A turning point for the market is here. though 1161 is not reached last week, but we do print the high 1150 on Thursday…time is always more important than price…

January 10, 2010

H&M and Wal-Mart destroy and trash unsold goods

Is this story familiar with u? remind u of mid-30s’ last century? it’s so sad to see this…

This week the New York Times reported a disheartening story about two of the largest retail chains. You see, instead of taking unsold items to sample sales or donating them to people in need, H&M and Wal-Mart have been throwing them out in giant trash bags. And in the case that someone may stumble on these bags and try to keep or re-sell the items, these companies have gone ahead and slashed up garments, cut off the sleeves of coats, and sliced holes in shoes so they are unwearable.

This unsettling discovery was made by graduate student Cynthia Magnus outside the back entrance of H&M on 35th street in New York City. Just a few doors down, she also found hundreds of Wal-Mart tagged items with holes made in them that were dumped by a contractor. On December 7, she spotted 20 bags of clothing outside of H&M including, "gloves with the fingers cut off, warm socks, cute patent leather Mary Jane school shoes, maybe for fourth graders, with the instep cut up with a scissor, men’s jackets, slashed across the body and the arms. The puffy fiber fill was coming out in big white cotton balls.”

The New York Times points out that one-third of the city's population is poor, which makes this behavior not only wasteful and sad, but downright irresponsible. Wal-Mart spokeswoman, Melissa Hill, acted surprised that these items were found, claiming they typically donate all unworn merchandise to charity. When reporters went around the corner from H&M to a collections drop-off for charity organization New York Cares, spokesperson Colleen Farrell said, “We’d be glad to take unworn coats, and companies often send them to us."

After several days of no response from H&M, the company made a statement today, promising to stop destroying the garments at the midtown Manhattan location. They said they will donate the items to charity. H&M spokeswoman Nicole Christie said, "It will not happen again," and that the company would make sure none of the other locations would do so either. Hopefully that's the final word

January 9, 2010

January 4, 2010

2010 Outlook

Happy New year!! first all, wish you and all your family a healthy and prosperous 2010.

The holiday season is over and before the first work day of the new year starts, let me give my outlook of the 2010. Don’t take it too seriously, just for fun…

1. USD rebound will be the theme of the year. EUR/EUR Target 1.2 at least, current level is 1.43

2. Stock market will retest 666 low. current level 1115

3. GOLD will see 800 area first before making new high. current level 1103. (I am not a big GOLD fun, but I may load some GOLD related ETFs when 800 area touched.)

4. OIL may touch 100 area again in 2010, but after that, it will retest the 30s low. Another choice is that it will go south from here directly.

5. BRICs will keep outperforming the Western world. China will slow down its growth a little bit. SSEC will visit 2000 area again, but will not make new low. current level 3200.

6. More banks will fall this year and commercial credit default will play out.