Monday, April 27, 2009

Economic

1:00pm Treasury’s 2-yr note auction

Events

10:00am AXP shareholder’s meeting. Trades Ex-dividend: ATR $0.15, AZ $0.324.

Earnings

Before the Open: ACV, ARLP, BEAV, BWP, CHKP, GLW, DEP, ENR, EPD, GLF, HUM, IMA, LO, ONB, OMC, PVTB, QCOM, SII, SOHU, SYNT, TKR, TZOO, VZ, WBC, WHR. After the Close: RNT, ACTS, ALB, AUTH, AXS, BIDU, CLDN, CMP, DVA, EDR, EW, ELX, FNF, FADV, HBI, HGR, HMA, HTLF, HXL, HIMX, ININ, IVAC, LDSH, XPRT, MTW, MAS, MTH, MSPD, MRH, OLN, PRXL, PRE, PNSN, PCL, RGA, RCII, RKT, SGK, SLG, SNWL, SONO, SWN, TUES, TYL, UHS, VECO, WRB, WRE, WRI, WMGI, XL.

Tuesday, April 28, 2009

Economic

9:00am Feb S&P/CS Home Price Index (last 146.4) Composite-20 y/y (last -18.97%)

10:00am April Consumer Confidence (last 26), April Richmond Fed Manufacturing Index (last -20)

1:00pm Treasury’s 5-yr note auction

4:30pm API Crude Oil/Gasoline/Distillate Inventories

Events

Barclay’s Capital Retail & Restaurant Conference. Consumer Electronics Assn. LA Games Conference. ICSC/UBSW Chain Store Sales (7:45, last -0.4%). Redbook Retail Sales (8:55, last 0.1%). ABC Consumer Confidence (last -47). Trades Ex-dividend: AOS $0.19, LNT $0.375. 3:30pm DNDN’s Provenge Conference Call (embargo ends 2pm).

Earnings

Before the Open: CAS, ADLR, AG, AMB, AMFI, AMED, AEE, ECOL, AM, AXE, ARM, AVY, BDX, BMS, BCO, BMY, CRS, CE, CNC, CCE, CVG, CPO, CVH, DIN, ELNK, ECL, EME, EVVV, FMER, FPL, BEN, FDP, GKSR, GPI, HCP, HL, HSII, HSP, IPG, JEC, KDN, KELYA, KLIC, LDR, LAZ, LCAV, LVLT, LECO, MHP, NXY, NWPX, ODP, OXPS, ORB, GLT, PCAR, PMTC, MALL, PAG, PCZ, PFE, PCH, QLTI, RDWR, COL, RTI, SMG, SSW, SPAR, STFC, TECH, TFX, TLAB, TPP, X, UA, VLO, VSH, WDR, WAT. After the Close: ACE, ACTL, ADVS, ATAC, ANAD, AJG, BLDP, BBSI, BEC, BTUI, BKI, BWLD, COG, CRI, CBI, CERN, CTV, CCUR, CSGS, CTS, DAC, DBTK, DWA, ETFC, EGP, EHTH, EAC, ENTU, EXAC, FALC, FIS, HTZ, HTCH, JLL, KEYN, LIFE, MEE, MRCY, MMSI, MEOH, MPWR, NLC, NATI, NAL, PNRA, PEET, PFWD, PRAA, PSYS, QCOR, RSYS, RFMD, RCKY, SBX, SMTL, SSTI, SRCL, SUMT, SUNH, JAVA, SDXC, TSS, TRMB, TRMK, ULTI, USNA, USU, VFC, VIGN, VISN, WTS, WBSN, ZRAN.

Wednesday, April 29, 2009

Economic

8:30am Advance Q1 Annualized GDP q/q (last -6.3%), Q1 GDP Price Index (last 0.5%), Q1 Personal Consumption (last -4.3%), Q1 Core PCE q/q (last 0.9%)

10:30am DoE Crude Oil/Gasoline/Distillate Inventories

1:00pm Treasury’s 7-yr note auction

2:00pm FOMC rate decision

Events

BoJ rate decision. MBA Mortgage Applications (7:00, last 5.3%). Trades Ex-dividend: SGP $0.065, RX $0.03, WY $0.25.

Earnings

Before the Open: AET, AKNS, ABK, AMT, ASCA, MT, ARW, ABG, ASPM, AVA, BHI, ABX, BDC, BLT, BKC, CNP, CBR, CTCM, DPZ, ENDP, EEFT, FCN, GD, GWR, GT, HES, HEP, HST, ICLR, IACI, JNY, KEI, LEA, LCRY, LAD, MPX, MKTX, MWV, MHS, MED, MDP, MTG, MCO, MPS, NJR, NYB, OIIM, ZEUS, OSG, PTI, PAS, PNW, PX, Q, RGS, RAI, ROK, ROC, RDS.A, RES, RTIX, RBCN, SAP, SVVS, SEE, SI, SLAB, SPIL, SO, SPW, SSYS, TLM, TXT, MDCO, TSCM, TWX, TWC, TEL, UMC, USAP, WMI, WEC, WRLD, WXS, WYE, WYN. After the Close: ABAX, AEA, AFL, AEM, AKAM, AMSF, AMKR, ARRS, AIZ, ATML, AVB, AXTI, BEZ, BARE, BRY, BMR, BXP, BDN, CBT, CAI, CDNS, CWT, CAVM, CBG, CBL, CIR, CRUS, CTXS, CLF, CNQR, CVD, CRAY, CCI, DRIV, DNEX, DLLR, DRC, DSCM, DST, DTE, DRE, DNB, EFII, EQR, ESS, RE, ESRX, FSLR, FLEX, FLS, FORM, GGP, GNK, GMR, GERN, GMKT, GMCR, GSIC, HAR, HIW, INSP, IFSIA, ICO, ITRI, JDSU, KALU, KEX, KONA, LOOP, LSI, MANT, MDAS, MOH, NAVG, NBIX, NEWP, NUHC, NTRI, OII, ODSY, OKE, OKS, OPWV, ORLY, OSIP, OI, PSEM, PLXS, PLD, STR, O, RNR, RJET, RNOW, RYL, SIGI, SFLY, SKX, SAH, SFN, SBUX, STM, SPN, SRDX, SMMX, TCO, TER, TTEK, TWPG, TLGD, CLUB, TRN, URI, UNM, VARI, VAR, VIMC, VIRL, V, WLT, WCAA, WGL, WLL, WSH.

Thursday, April 30, 2009

Economic

8:30am March Personal Income (last -0.2%), March Personal Spending (last 0.2%), March PCE Deflator y/y (last 1.0%), March PCE Core (last m/m 0.2%, y/y 1.8%), Initial Jobless Claims (last 640K), Continuing Claims (last 6.137M)

9:45am April Chicago Purchasing Manager Index (last 31.4)

10:00am April NAPM-Milwaukee (last 30)

10:30am Natural Gas Inventories

Events

8:00am FDA Risk Communication Committee meeting. Trades Ex-dividend: SO $0.438.

Earnings

Before the Open: FLWS, EYE, ATG, LNT, APU, APA, AWI, ARTG, ASH, AACC, AZN, ATN, BLC, BIOS, BWA, BYD, BC, BW, BBW, CACH, CCC, CALP, CPLA, CRR, CAH, CBZ, CDI, CELG, CEDC, CTL, GTLS, CI, CINF, CMS, CL, CMCSA, CITP, COCO, COV, CRY, CMI, DLR, DXYN, D, DDE, DVD, DOW, EK, ELMG, NPO, ENTG, EQT, ETH, EXPE, XOM, FAF, FORR, RAIL, GM(unconfirmed), GLS, GTIV, GEO, GTI, HS, HTV, HPY, HP, HOS, HURN, ICON, ICTG, IFLO, IPCC, IFF, IP, ITG, IWA, IRM, KBR, KSU, K, KIM, LB, LANC, LFUS, LKQX, ERIC, LOJN, LZ, MHO, CLI, MGLN, MGA, MRO, HZO, MSO, MBFI, MFA, MDS, MSA, MOT, MWIV, MYL, NNN, BABY, TNDM, NWL, NEM, NBL, NOVA, NRG, NUS, NS, NYX, OMX, OHI, OCR, OSK, OSIS, OC, PMTI, PTEN, PCCC, PEI, PPCO, PTEC, POZN, PDE, PG, QCCO, QUIX, RYN, RGC, RRI, REV, RSTI, SWY, SRE, SEPR, SHPGY, SBNY, SLGN, SNN, SPR, HOT, STRA, TSM, TEN, TBL, TRV, TWP, TRW, TYC, UGI, ULBI, UTHR, VCI, VIA.B, VIP, VPHM, WPI, WMAR, WST, WMB, WPZ, XEL. After the Close: APKT, ACTU, ACS, AXB, AIQ, ACAP, ANEN, NLY, AMCC, ARBA, ALC, ATHN, ATO, AVNX, BGFV, BMRN, BLKB, BPL, CAB, CAP, CLMS, ELY, CALD, CPT, BEAT, CBEY, CEC, CQB, CHH, FIX, CML, SCOR, CVTI, CW, PROJ, XRAY, DEPO, DLB, BOOM, ERES, ESLR, FARO, FISV, BGC, GXDX, GPRO, GFIG, GOL, HNSN, HIG, HVT, HMN, IDEV, IM, IDTI, TEG, IN, ITMN, LQDT, LVS(unconfirmed), MXIM, MFE, MET, MTD, MCHP, MCRS, MSTR, MIPS, MORN, MRT, NANO, NFG, NETL, NTCT, N, NR, NTLS, ORH, ASGN, ORCC, PCTI, PDGI, PMC, QLGC, RADS, RSG, SONE, SGMO, SQNM, SWIR, SSD, FIRE, STNR, TLEO, TTGT, TWLL, TK, TSYS, TSRA, THOR, TGI, TTMI, UNCA, UDRL, USTR, VSEA, VPRT, VLCM, WYNN, ZIGO.

Friday, May 01, 2009

Economic

10:00am April Final U. of Michigan Confidence (last 61.9), April ISM Manufacturing (last 36.3), April ISM Prices Paid (last 31), March Factory Orders (last 1.8%)

Events

Total and Domestic vehicle sales. Trades Ex-dividend: LEN $0.0.4, CLMT $0.45, CV $0.23, ABFS $0.15.

Earnings

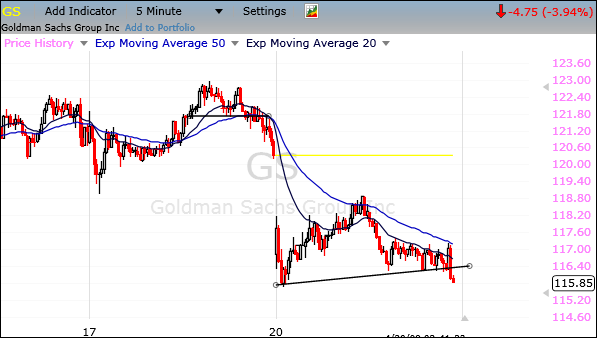

![[zshortterm2.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjsLJiVL22MEKMG__JqUpms5VF2vyzgToq4O0A0aiU2YfF7dgTC6bm9Slanlux8UsAWmIlqlCohpNm04Zl_vGqPpsv4f8STFeLKbNmpqysoY3wuF5V0hgfQLINb04g1xWp2u3TP6-wOxilb/s1600/zshortterm2.png)