wow, a big typo below, just correct it~ sorry guys

3:51pm

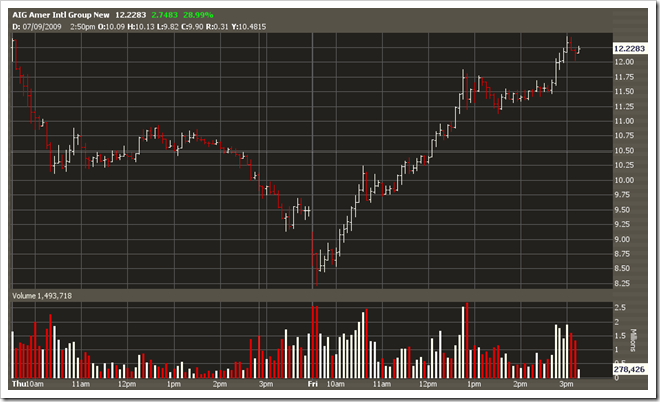

new no low ahead tomorrow…

3:37pm

OK, bulls finally broke the resistance. This is more consistent with my expectation since based on my wave count, this one is on a larger degree than the ones we have in the past two days. Also the positive divergence should lead the market higher. But again, main trend not change and no longs from here…

3:27pm

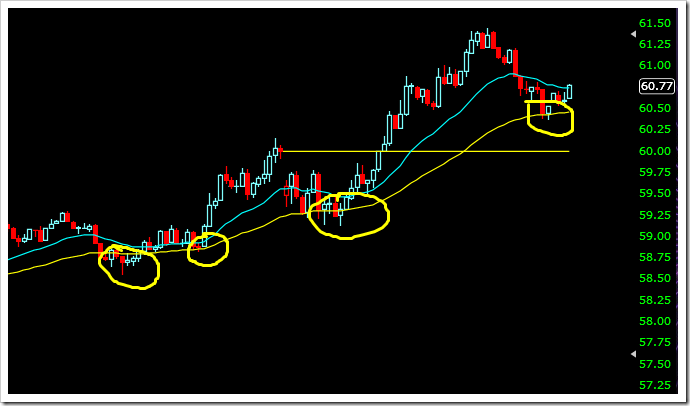

it holds again this time:) if you are doing ST, you really do not need to care about these intraday noises, just trade the main trend and move your stops slowly when you get the profit.

3:02pm

hold on your short well, it’s just a shake.

2:55pm

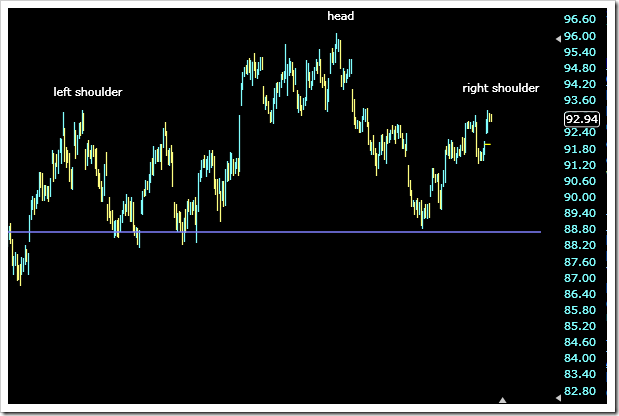

SPY—to our magic line again, not sure if it will hold this time. negative divergence on different time frames.

2:09pm

this is SPY

1:53pm

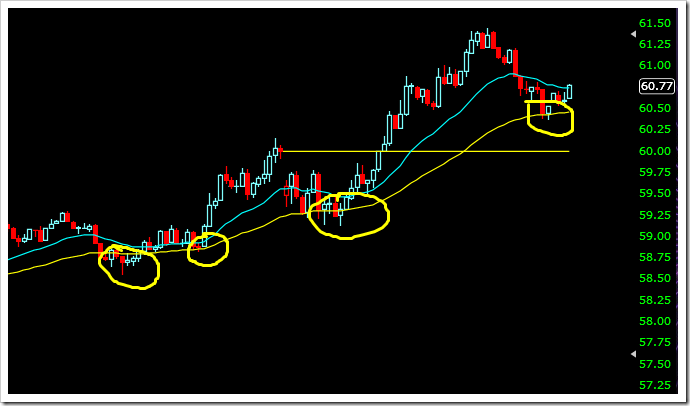

if you can not find a entry, just use our magic line… see how well it plays out for SDS? it’s all the same for SPY TMW DIA…

12:38pm

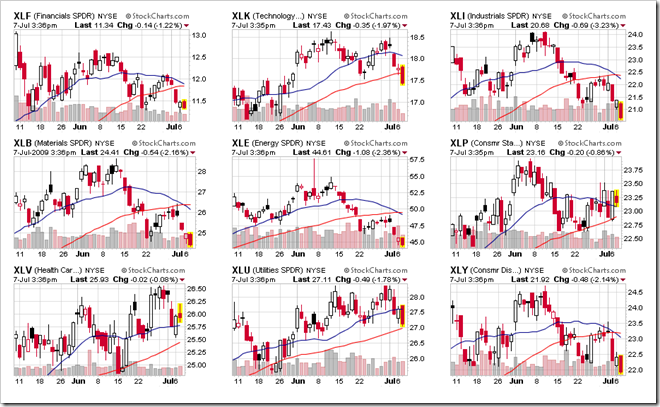

I hope you guys are having fun with this downtrend. Today’s key topic is weak dollar and weak gas, (yeah, we seldom see this) and CNBC is talking about whether US dollar reserve currency status will be replaced or not. This is a good question. My answer is yes, but not now. we will discuss this more in later days…

4:47am

the future is turning green right now, we can see some rebound tomorrow in the morning.

3:25am

market still has lots of room in the midterm. if market up tomorrow, it’s good chance to add short.