Review summary: next week down

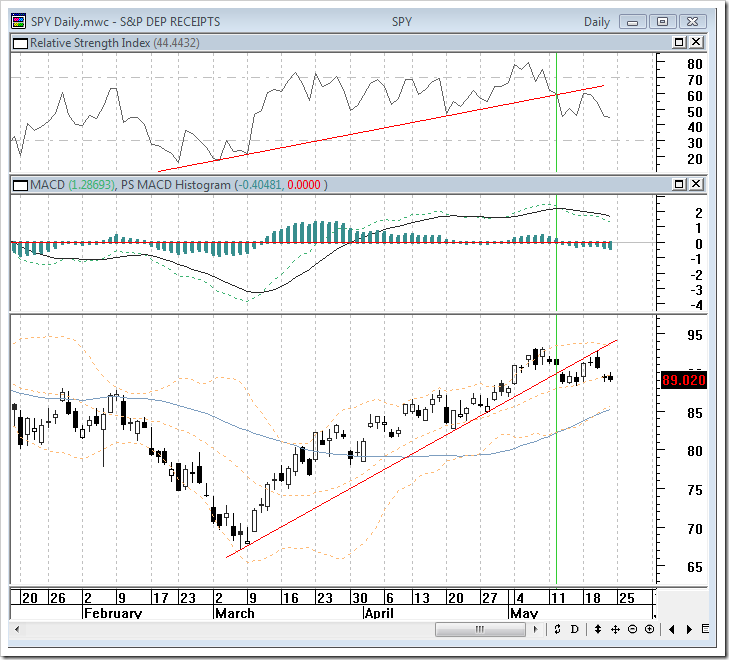

I hope you guys were having a wonderful long weekend and now are ready for a new trading week. I reviewed many charts this afternoon and would like to share with you a few interesting ones. I sense that market is going to fall hard soon, may just start from tomorrow

Midterm top signals are shown up and momentum are heading lower. Two reversal bars printed on the weekly candles. You can see such scenarios on many Index. Based on the weekly STO strength, this upward wave is on the same level as the 2008 march-may wave; thus it’s pretty consistent with my labeling that my this is the wave 4 of major wave a. wave 5 is now underway. we still have a long way to go, a very long one.

I mentioned in last intraday update that key thing to watch is the close and important level is 20 DMA. Finally bears, for the 1st time since this rally, has solidly close the last session under the support level. Momentum has closed at a lower level and I would expect price to follow. Just follow the chart carefully you will see the momentum is leading the price nicely these days. This is some old TA, but it still rocks! :)

potential heand & shoulder pattern? this is a scenario that many traders are talking about, but i keep it as my 2nd choice. just put it here for your reference. I seriously doubt if market will join the majority this time.

US Dollar ETF UUP has bleached the mid-term uptrend a few weeks ago and last Friday, it closed right on a key support level. If the US dollar is going a free fall here, the same thing will happen to the US equities. Maybe some of you may argue with me that a weak US dollar is good for the commodity sector and benefit the gold/Oil related sectors. That’s correct. But, a free-fall US dollar is damaging to the economy and market in many ways. A most straightforward impact is the tank of investor’s confidence, which will result in outflow of the capital from US equity and bond market. another consequence is the rise of the interest/mortgage rate to leverage the inflation… housing price further down… bank bad asset further devastating… finance/credit risk… one more round of…

VIX reversal pattern: VIX finishes a classical three-step reversal pattern last week. For a $VIX confirmed signal you need 3 things:

- a close outside of the 2.0 Bollinger Band (20 day, SMA (check - happened on Friday)

- a close back inside the 2.0 Bollinger Band - this issues the signal (check - happened today)

- a higher close (sell) or lower close (buy) than the close of the day back inside the 2.0 Bollinger Band

Another CPC topping signal for your reference:

![[cpc.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiiB4zMtFF1qAcgjFH-Hsmu6aa181woSDXU8iuxBYPYT6Od2Ke55MGoih1N7XO1GAt4tqoBYAMLKIJ4h8FL3oaNdy5uw6TOLMA0wPPlSEYVN1u5zNhzUitngcxkOPsWywIqtU0JEZfP80Q/s1600/cpc.png)

1 Good Insights:

Nice short squeeze for a start.

Like your analisys. Keep up the excelent work !!

Post a Comment